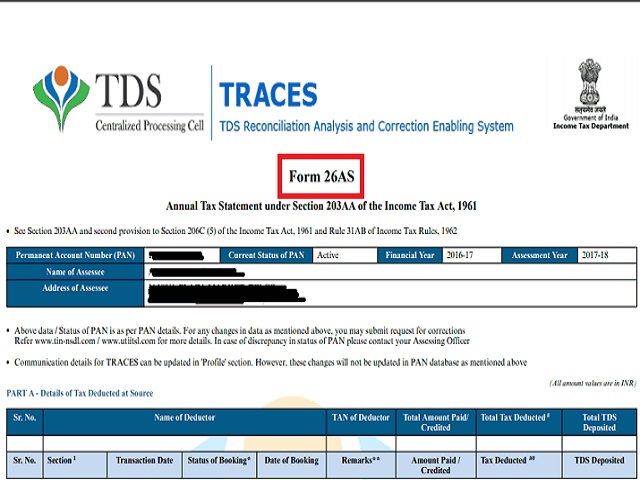

In this article we shall see different ways of viewing Form 26AS. Till 31st Oct 2012 Tax Information Network (TIN) by NSDL() was used to collect information about Tax Deducted at Source (TDS) on behalf of Income Tax Department (ITD). It enables viewing of challan status, downloading of NSDL Conso File, Justification Report and Form 16 / 16A as well as viewing of annual tax credit statements (Form 26AS). TRACES has been created to enhance swift interaction between the deductor, deductee, income-tax department and CPC.

In our article TDS, Form 26AS and TRACE we explained about the new initiative of Income Tax Department (ITD) for information about Tax Deducted at Source (TDS) called TRACES or TDS Reconciliation Analysis and Correction Enabling System.

0 kommentar(er)

0 kommentar(er)